Black Monday

The Guardian explaining the Black Monday.

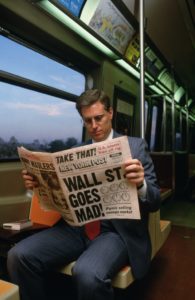

On October 19, 1987 stock markets around the world crashed, a global financial crisis which started from Hong Kong and was spread to Europe and the United States as well. It came be to known as the Black Monday.

James Marshall/Corbis via Getty Images

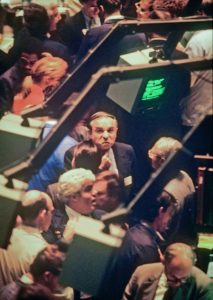

Wall Street went mad. The Dow Jones Industrial Average fell 508 points (22%) to 1738.74, a $500 billion decrease in value which is still the biggest one-day loss in the history of the index. S&P 500 also dropped 57.64 points (20.4%) to 225.06.

There have been numerous reasons as to why this massive drop happened. Although many blame stock trading programs of the time for the crash, but the most common belief is that fear and panic were the main reasons for the 1987 financial crisis.

Mario Cabrera/AP

New York Stock Exchange trading floor on Black Monday (Peter Morgan/AP)

New York Stock Exchange Traders/AP

AP/Mario Suriani

AP/Mario Suriani

The Independent/Rex Features

First Union Brokerage Services, the following day/AP/Kathy Willens

Photo: Andrew Popper

NYSE Chairman John J. Phelan, Jr/Photo: Andrew Popper

Photo: Maria Bastone/AFP/Getty Images

Also watch

Further Reading

The Crash of ’87, From the Wall Street Players Who Lived It