Loss Aversion

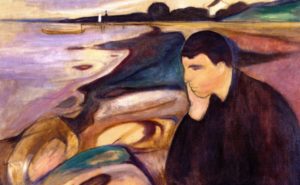

Edvard Munch

“In trying to make sense of this pessimism, Ridley, like Kahneman, sees a combination of cognitive biases and evolutionary psychology as the core of the problem. He fingers loss aversion—a tendency for people to regret a loss more than a similar gain—as the bias with the most impact on abundance. Loss aversion is often what keeps people stuck in ruts.”

Peter H. Diamandis

“I think one of the major results of the psychology of decision making is that people’s attitudes and feelings about losses and gains are really not symmetric. So we really feel more pain when we lose $10,000 than we feel pleasure when we get $10,000.”

Daniel Kahneman

If owning stocks is a long-term project for you, following their changes constantly is a very, very bad idea. It’s the worst possible thing you can do, because people are so sensitive to short-term losses. If you count your money every day, you’ll be miserable.

Daniel Kahneman

People hate to lose and that is definitely no secret. But the extent of this phenomenon is way broader than you might imagine. Countless marketing strategies rely on the cognitive biases of humans and loss aversion is an important one of them which affects the process of decision making. Loss aversion is closely linked to the Endowment Effect, the Sunk Cost Fallacy and Status Quo Bias.

Loss aversion can be simply defined as “losses loom larger than corresponding gains.” It refers to the fact that people actually prefer to avoid losses rather than acquiring gains. Simply put, people prefer find it better not to lose $50 than receiving the same $50. This phenomenon was first introduced by Amos Tversky and Daniel Kahnemann in 1979 in the framework of prospect theory. In their 1992 paper, “Advances in prospect theory: Cumulative representation of uncertainty”, they have suggested that individuals experience losses twice as powerful as gains. Usually, people have a loss aversion ratio between 1.5 and 2.5, which means that for example if they are going to bet a certain amount, the outcomes must be on average about two times more than the losses for them to find that bet as interesting.

Many studies have discovered the vital role of Loss Aversion in the process of decision making. For instance, people are reluctant to sell their housing for a price less than what they have purchased it. Such behaviors, in a falling market, will result in more financial loss. Another example would be the fact that although most people know that working for themselves might be better than working for someone else, but they do not quit their jobs to start their own businesses. Why? Because of Loss Aversion. Because the idea of losing a safe monthly income is too scary for the majority of people.

In a similar study in 2015, it was discovered that European people know the interest rate they get for their savings accounts but they are reluctant to know the interest they pay for their debts.

Further reading

Advances in prospect theory: Cumulative representation of uncertainty

Loss Aversion Bias | Why you should not fall in this trap?

The Psychology of Loss Aversion

Are you exhibiting symptoms of loss aversion?